Operating profit on turnover formula

Non-operating revenue refers to earnings that are generated from sources other than core operations. One big benefit of learning how to figure out finished goods inventory is that you can find your finished goods inventory turnover rate.

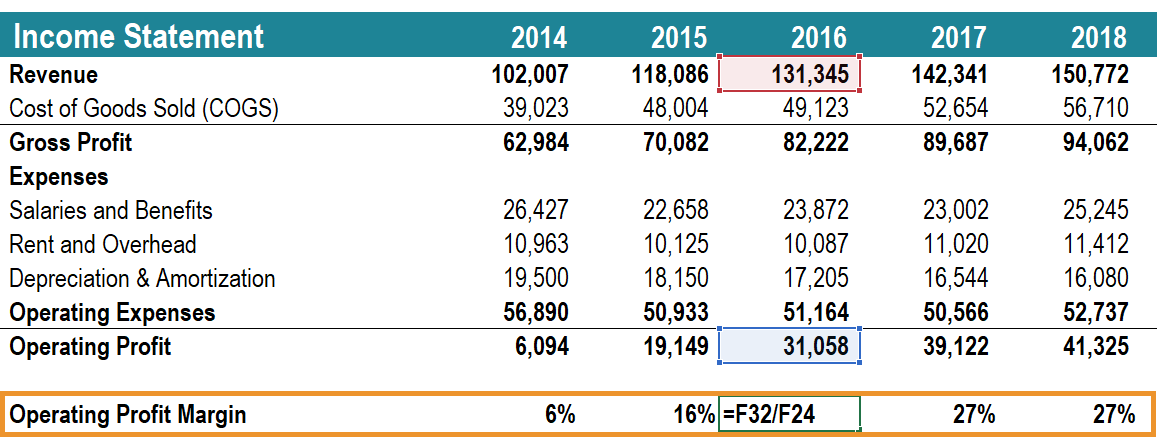

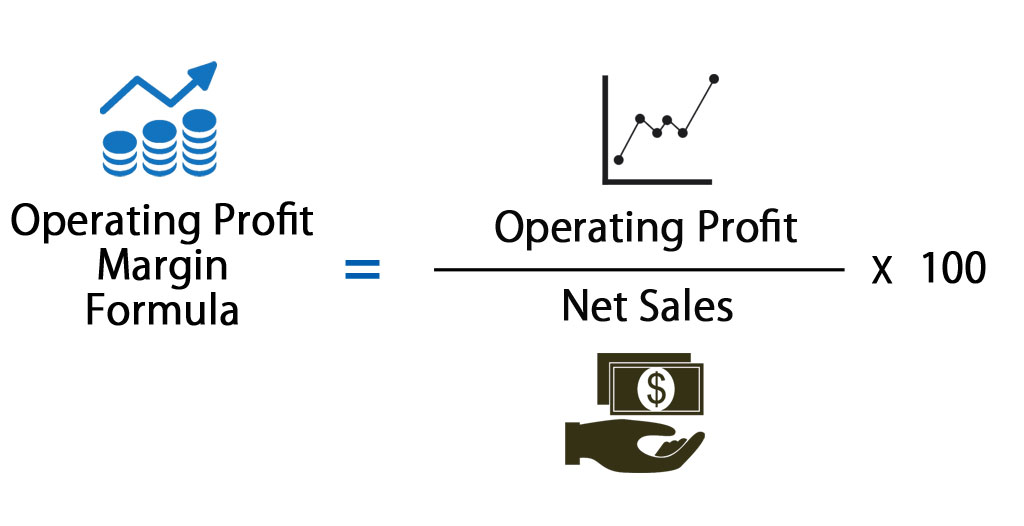

Operating Profit Margin Learn To Calculate Operating Profit Margin

So Interquartile Range 43 If you see the data set the median of this set is.

. The operating income is the gross profit or profit generated by the company minus operating expense which includes selling general and administrative expenses amortization depreciation of assets rent salary of employees insurance commission postage expense and supplies expense. The term revenue represents the total business income obtained during a period of time. Working Capital Turnover Ratio.

Both values can be obtained from the Income statement. Let us take another example of a Portfolio of three securities yielding Actual Returns of 5 8 and 7 during last year. Two components of the formula of receivables turnover ratio are net credit sales and average trade receivables.

Correlation 4 098 012 Correlation 3401 Explanation. The formula to calculate the Operating Profit is. Finished Goods Inventory Turnover Rate.

Alpha Formula Example 2. We take Operating profit in the numerator and Net sales in the denominator. For example a company may sell real estate or intellectual property for cash.

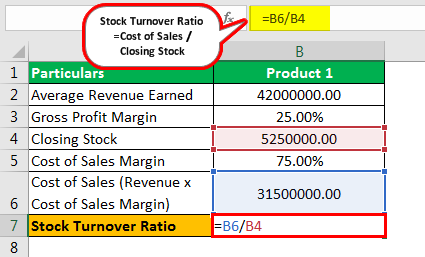

Interquartile Range 15 5. Operating profit Gross Profit Operating Expenses. Firstly determine the COGS of the subject company during the given period.

You can easily calculate the Inventory Turnover Ratio using the Formula in the template provided. One may calculate it by dividing the net sales by the average fixed assets. In the first example First we calculate Average.

Though that may also indicate a potential for costly backorders. However in examination problems the examiners often dont provide a separate breakdown of cash and credit sales. Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes.

Operating revenue and non-operating revenue are often wrongly referred to as something similar. To calculate net profit for a venture such as a company division or project subtract all costs including a fair share of total corporate overheads from the gross revenues or turnover. Alpha 6 5.

It measures the rate at which a companys finished goods inventory is sold and replaced turned over during a set. Alpha 1 Therefore the Alpha of the Portfolio is 1. The formula for the operating expense can be derived by using the following steps.

Also Operating Profit Margin Operating Profit Total Sales. Finally the formula for profit can be derived by subtracting the total expenses step 2 from the total revenue step 1 as shown below. The days in the period can then be divided by the inventory turnover formula.

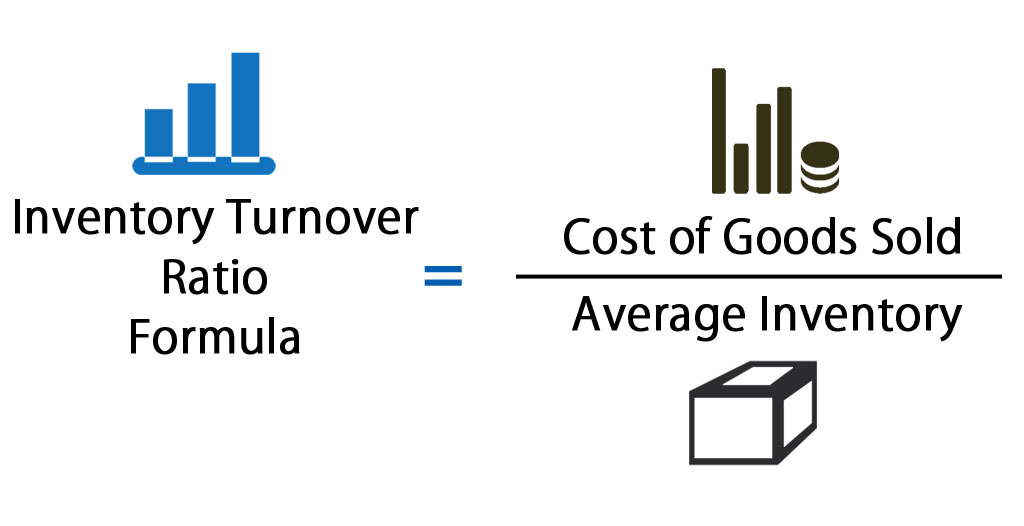

Inventory turnover is a ratio showing how many times a companys inventory is sold and replaced over a period of time. Operating Ratio Formula Operating Expenses Net Sales 100 read more is higher the company would. The fixed asset turnover ratio formula measures the companys ability to generate sales using fixed assets investments.

It is very easy and simple. Profit Percentage Formula Example 2. Net Operating Income Total Revenue Cost of Goods Sold Operating Expenses.

Formula of receivables turnover ratio. Profit margin is calculated with selling price or revenue taken as base times 100. Such costs can be determined by identifying the.

N12 202 10 th value ie. Same as step 3 above. Operating Profit Percentage 2725.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Same as step 2 above. Explanation of Operating Income Formula.

It shall be noted that the annual turnover figure is the sales figure before deducting the purchase direct expenses Direct Expenses Direct cost refers to the cost of operating core business activityproduction costs raw material cost and wages paid to factory staff. It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. The term profit represents the gain.

This is a guide to Turnover Ratio Formula. In business turnover is not the same as profit. In many cases it involves the sale of assets.

The formula for free cash flow can be derived by using the following steps. You may also look at the following articles to learn more Example of Capital Gain Formula. Network Inc established its business in the market successfully.

Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts. Finally the formula for net operating income can be derived by subtracting the cost of goods sold step 2 and other operating expenses step 3 from the total revenue step 1 of the company as shown below. Here we discuss how to calculate the Turnover Ratio Formula along with practical examples.

43 this is the same as Q2. If the operating ratio Operating Ratio Operating Ratio refers to a metric determining how efficient a companys management is at keeping operating costs low while generating revenues or sales by comparing the total operating expenses of a company to that of its net sales. Operating Profit Margin formula.

Correlation is used in the measure of the standard deviation. Average Inventories and Cost of goods sold. Interquartile Range 10 th data point.

Relevance and Uses of Net Operating Income. Thus the annual turnover of the trader is 60000. A raw materials inventory turnover rate higher than that means that a companys raw materials are used and replaced frequently.

Here we will do the same example of the Inventory Turnover Ratio formula in Excel. A coefficient of 1 means a perfect positive relationship as one variable increases the other increases proportionally. We also provide a Turnover Ratio calculator with a downloadable excel template.

Profit Total Sales Total Expense. Finished goods inventory turnover rate is a ratio. The fixed asset turnover ratio measures a companys efficiency and evaluates it as a return on its investment in fixed assets such as property.

125000 60000. Let us understand the formula for Operating Profit. Firstly determine the net income of the company from the income statement.

Profit margin is a profitability ratios calculated as net income divided by revenue or net profits divided by sales. An inventory turnover ratio of between 4 and 6 is considered an ideal balance between sales and replenishment. Operating Profit Percentage 16350 60000 100.

Net income or net profit may be determined by subtracting all of a companys. COGS is the aggregate of cost of production that is directly assignable to the production process which primarily includes raw material cost direct labor cost and. Net profit sales revenue total costs.

Operating Profit Net Sales Operating expenses. The formula states that the numerator should include only credit sales. Networking Inc is a Bag manufacturing company that manufactures all types of bags like travel bags School bags Laptop bags and so on.

You need to provide the two inputs ie. The formula for Operating Profit Margin is similar to other profitability ratios. Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below.

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis

Stock Turnover Ratio Meaning Formula Calculate Interpret

Inventory Turnover Ratio Formula Calculator Excel Template

Operating Income Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio Formula And Calculator

Dupontmodeleng Dupont Analysis Wikipedia Dupont Analysis Analysis Management Techniques

Pin By Lynsi Ingram On Safebooks Accounting Basics Learn Accounting Accounting Notes

Asset Turnover Ratio Formula And Calculator

Asset Turnover Ratio Formula Calculator Excel Template

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Operating Profit Margin Formula Meaning Example And Interpretation

Operating Profit Margin Formula Calculator Excel Template

Working Capital Turnover Ratio Formula And Calculator

Operating Margin What It Is And The Formula For Calculating It With Examples

Types Of Activity Turnover Ratios Financial Ratio Accounting Books Financial Analysis

Profitability Ratios Personal Finance Organization Financial Management Managing Finances